I’ve never previously felt the urge to check my mpg, but though the run to the Nationals today would be a chance to verify the bad news.

Massive surprise …..I used 9 gallons (rounded up) for 187 miles = 20.75 mpg

This is from a 383, Holley d/p and cammed motor!

It was a fairly steady run but there were still numerous “uneconomical“ moments. Well happy with over 20mpg.

Be lucky your Corvette is not brand new in the USA and get wacked with the GGT tax

This crap will give you heartburn

Calculation Technique

The Gas Guzzler Tax for each vehicle is based on its combined city and highway fuel economy value. Manufacturers must follow U.S. Environmental Protection Agency (EPA) procedures to calculate the tax. The calculation uses a formula that weights fuel economy test results for city and highway driving cycles (the combined value is based on 55% city driving and 45% highway driving). Fuel economy values are calculated before sales begin for the model year.

The total amount of the tax is deter-mined later and is based on the total number of gas guzzler vehicles that were sold

that year. It is assessed after production has ended for the model year and is paid by the vehicle manufacturer or importer.

EPA and manufacturers use the same test to measure vehicle fuel economy for the Gas Guzzler Tax and for new car fuel economy labels. However, the calculation procedures for tax and label purposes differ, resulting in different fuel economy value

This is because an adjustment factor is applied to the fuel economy test results for purposes of the label, but not for the tax.

The adjustment is intended to help account for the differences between “real-world” and laboratory testing conditions.

EPA conducts fuel economy tests in a laboratory on a dynamometer (a device similar to a treadmill). Laboratory conditions can be different from real world conditions for such parameters as vehicle speeds, acceleration rates, driving patterns, ambient temperatures, fuel type, tire pressure, wind resistance, etc.

EPA studies indicate that vehicles driven by typical drivers under typical road conditions get approximately 70 to 90 percent of the laboratory test-based city miles per gallon (MPG) value and approximately 70 to 80 percent of laboratory highway MPG value. This difference is referred to as “in-use shortfall.”

To account for the in-use shortfall, the city and highway MPG values listed in Fuel Economy Guide and shown on fuel economy labels are based on fuel economy test results of the city and highway tests plus three additional tests. The three additional tests measure fuel economy

1) at cold ambient temperatures,

2) at warmer temperatures with the air conditioner running, and

3) when operated at high speeds and high acceleration rates.

However, the combined city and highway fuel economy that is used to determine tax liability is not adjusted to account for in-use shortfall, so it is higher than the MPG values provided in the Fuel Economy Guide (

www.fueleconomy.gov) and posted on the window stickers of new vehicles.

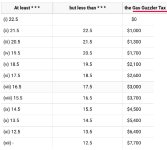

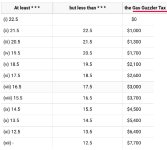

Tax Schedule

The IRS collects the tax directly from the manufacturer or importer of the vehicles.

The following table shows the gas guzzler tax rates which have been in effect since January 1, 1991.

The manufacturer or importer must pay this amount for each vehicle that doesn’t meet the minimum fuel economy level of 22.5 MPG