You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

$110 Bucks Fill-UP

- Thread starter teamzr1

- Start date

Roscobbc

Moderator

You are sooooo lucky........same fill up here in UK is at least £135 (probably more).....and thats UK Pounds Sterling......not US Dollars.

Roscobbc

Moderator

Me, I used to average 25k to 35k miles a year when working some years back.....reduced in recent years to perhaps 15k and now l'm lucky to get anywhere near 5k miles a year. I'm guessing for many it will still be 8k to 12k. Living here in an outer London borough due to congestion and made far, far worse by the cycle routes, daily congestion charges (and now an everyday emission charge on top for many older vehicles I'm deliberately walking and using public transport where possible......or just not bothering......

For you guys however who live 'out there in the sticks' where you'll drive three figure distances just to visit a grocery store or fill up with gas and on poor provincial wages (or unemployed) the hardship must be very real!

For you guys however who live 'out there in the sticks' where you'll drive three figure distances just to visit a grocery store or fill up with gas and on poor provincial wages (or unemployed) the hardship must be very real!

antijam

CCCUK Member

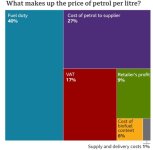

The current average annual mileage of british cars is 7400 miles. Their average fuel consumption is 38.3 mpg. So, with the price of petrol now hovering around £2/litre the average annual car fuel bill is around £1750.

If I were to do 7400 miles in my C3 I think the cost would be somewhat higher.....

If I were to do 7400 miles in my C3 I think the cost would be somewhat higher.....

James Vette

CCCUK Member

I'll look after them.

Roscobbc

Moderator

An 'intelligent' UK political party could really take advantage of this situation...........and publish a new manifesto for the next general election promising to be more 'transparent' on the effects of taxes on the cost of fuel to us all and repealing all those years of governmental abuse, perhaps promoting the use of 'pay by mile' as an alternative. Surely this will be the way for electric vehicles and what 'smart meters' are really for.........

Realistically it will never happen........the revenues from petrol and derv are far too great to ignore...........however all future governments will need to carefully plan how to 'fleece' us when use of electric vehicles dominates. Tesla owners and their Supercharger stations will be 'hit' big time.

Realistically it will never happen........the revenues from petrol and derv are far too great to ignore...........however all future governments will need to carefully plan how to 'fleece' us when use of electric vehicles dominates. Tesla owners and their Supercharger stations will be 'hit' big time.

GCorvette

CCCUK Member

More likely to find a Unicorn grazing in your garden....An 'intelligent' UK political party could really take advantage of this situation...........

teamzr1

Supporting vendor

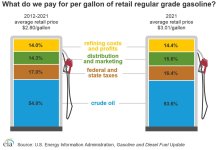

As of last year, costs below

Useless today as gas prices go up daily L-(

US Federal, state, and local government taxes also contribute to the retail price of gasoline.

The federal excise tax is 18.40¢ per gallon (cpg), [Cents Per Gallon] and state gasoline fees and taxes range from a low of about 15 cpg in Alaska to as much as 68 cpg in California and around 59 cpg in Illinois and Pennsylvania.

On average, state taxes and fees average about 39 cpg and when combined with federal taxes average 57 cpg at the pump.

Sales taxes along with taxes applied by local and municipal governments can also add to gasoline prices in some locations.

Useless today as gas prices go up daily L-(

US Federal, state, and local government taxes also contribute to the retail price of gasoline.

The federal excise tax is 18.40¢ per gallon (cpg), [Cents Per Gallon] and state gasoline fees and taxes range from a low of about 15 cpg in Alaska to as much as 68 cpg in California and around 59 cpg in Illinois and Pennsylvania.

On average, state taxes and fees average about 39 cpg and when combined with federal taxes average 57 cpg at the pump.

Sales taxes along with taxes applied by local and municipal governments can also add to gasoline prices in some locations.